Why did we create a better solution to impact investing?

Many investors who put their money in the hands of traditional investment managers that promote “Environmental, Social, Governance (ESG)” and “socially responsible investing” have good intentions – but the reality is, they may actually be investing in ways that inadvertently cause social, economic, and environmental harm.

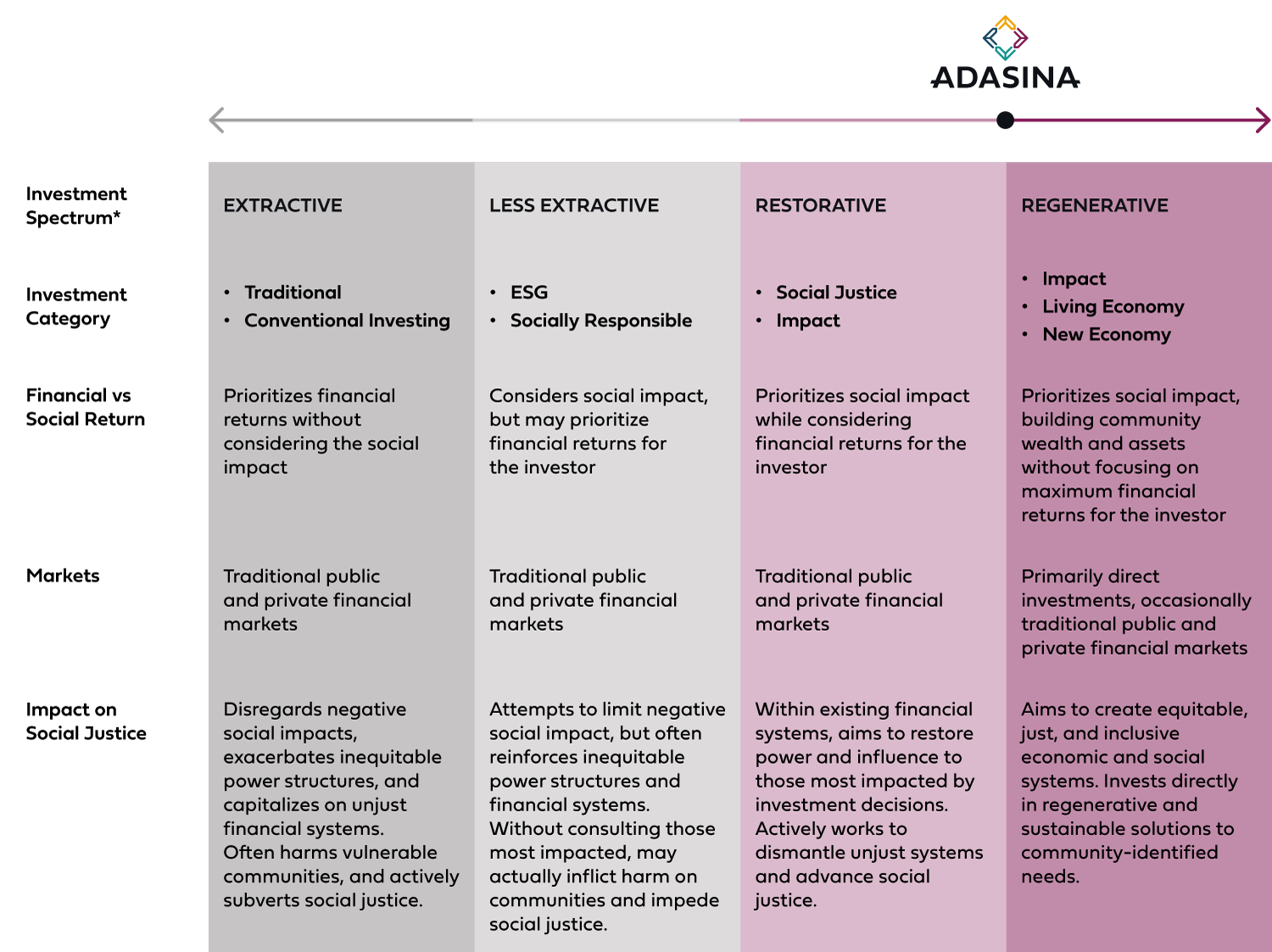

We occupy a unique place in the financial industry, offering both restorative and regenerative investment solutions that center the goals of social justice movements in our approach.

*The Extractive to Regenerative Spectrum was originally introduced by Justice Funders as a guide for social justice focused philanthropy. It has been adapted here for the investment industry.

The Adasina Social Justice Investment Criteria:

Together with social justice organizations, we developed the Adasina Social Justice Investment Criteria– a data-driven set of standards that guides our investment strategies to reflect social justice values and advance progressive movements for change.

These data sets determine where to “draw the line” so that public companies and governments can choose which side of justice they stand on. This informs our investment and divestment decisions. We further leverage this community-sourced data to educate and organize the investment industry to effect positive, systemic change for people and the planet.

These criteria focus on four intersectional issue areas:

Our Racial Justice criteria aims to uproot systems that reinforce, perpetuate, and exacerbate racial inequities. Our goal is to abolish profit from corporate participation in unjust systems.

Our investment criteria include:

- For-Profit Colleges

- Money Bail Involvement

- Prison Labor

- Prison Involvement

- Immigrant Detention

- Surveillance

- Occupied Territories

- Diversity & Inclusion Policies

Our Gender Justice criteria seeks to promote equality for all, regardless of their gender identity. We divest from companies with policies and practices that do not support gender equity and LGBTQ+ equality.

Our investment criteria include:

- Equal Employment Opportunity for Women

- Sexual Harassment

- Reproductive Rights

- LGBTQ Equal Employment Opportunity

Our Economic Justice criteria seeks to create a fair and equitable financial future for all people and communities. We divest from companies who fail to deal fairly with the public or their employees.

Our investment criteria include:

- Predatory Lending

- Human Slavery & Child Labor

- Worker Protections & Rights

- Working Conditions

- Livable Wages

- Excessive Executive Pay

Our Climate Justice criteria aims to advance the goals of environmental sustainability. We do this by divesting from companies substantially contributing to climate change in ways that disproportionately impact poor communities and people of color.

Our investment criteria include:

Invest With Us

With Adasina, we offer several ways to access our Social Justice Investing Approach.

Use Adasina in Your Existing Stock Portfolio

Coming Soon!

The Adasina Social Justice Index is a global universe of public equities across all major asset classes screened for social justice. We apply a data-driven set of investment standards to the index, built to support progressive movements for change. Investors can work with their current financial advisor to apply the Adasina Social Justice Index for public equities to their current portfolio. There is $0 minimum investment required. Sign up for our email list to get notified when this launches.

Seek Racial Justice with Municipal Bonds

The Adasina-Activest Fiscal Justice Strategy is a fixed income portfolio intended to advance racial and economic justice by investing directly in Black communities across the US. This strategy infuses these communities with much-needed capital for funding sustainable, long-term economic opportunities. The minimum investment for the Adasina-Activist Fiscal Justice Strategy is $1 million

Transform Your Entire

Portfolio

Adasina’s Social Justice Portfolios offer the opportunity to integrate our social justice investing approach across the stocks, bonds, and cash in your investment portfolio. These accounts are well-suited for investors who wish to create a values-aligned, automated retirement or brokerage account. The minimum investment for an Adasina Social Justice Portfolio is $100,000.

FAQs

Adasina Social Capital is not simply an ESG firm. Our mission is to provide social justice groups and impact-driven investors with a platform where people, investments, campaigns, and education work in unison to drive large-scale, systemic change. This change must extend well beyond our own investments to the wider financial ecosystem, never losing sight of the transformative influence on our communities and the planet.

We partner with social justice movements to identify companies and governments whose practices are recognized as particularly harmful to impacted communities. We also use this data to educate and mobilize other investors with campaigns that amplify the needs, perspectives, and voices of impacted communities throughout the financial system.

What makes our investment approach so groundbreaking is that we’re the first to source our data primarily from social justice organizations and activists from the communities most impacted by systemic injustice.

Together with our research partners, we combine data provided by our social justice partners with commercially available data to determine where companies stand on issues of racial, gender, economic, and climate justice.

You don’t have to switch your current wealth management firm or leave your family office to work with us. With Adasina you can invest in a way that is truly aligned with your values and maintain the relationships that are important to you.

Talk to your current financial advisor about how to use the Adasina Social Justice Index or the Adasina-Activist Fiscal Justice Strategy in your current portfolio. If your advisor is not already familiar with our investment solutions, reach out to let us know. We’ll be happy to coordinate speaking with them directly.

Our fees vary depending on the investment solution. Reach out to us, we’ll be happy to share the fees that are most relevant to your interest.

At Adasina, we value transparency. In order to do this work and pay our team of experts to rigorously screen our investments and lead industry-wide campaigns, we ensure our fees are reasonable and comparable to the market – and they go straight to our firm, supporting a regenerative, Black-owned business led and staffed primarily by women, people of color, and members of the LGBTQ+ community.